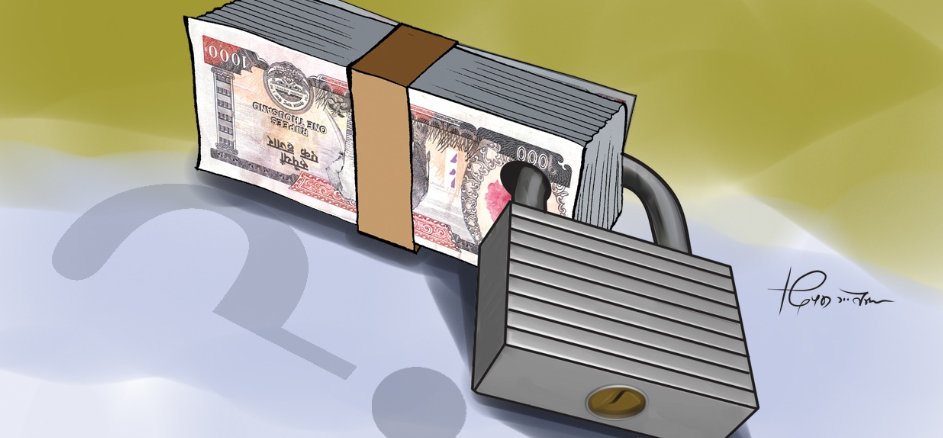

Rs 188 billion of the general public piled up in inactive accounts

Agency: Bhimsen Bohora of Ramechhap has so far opened accounts in 11 banks. However, he currently transacts only through two bank accounts. Teaching at private colleges, he had opened accounts at different banks to receive his salary from different educational institutions. But after using those accounts for some time, they became inactive. Since he did not transact through them, the accounts became inactive.

“I ended up opening accounts in 11 banks,” he says, counting with his fingers. “As I changed institutions during my teaching career, the number of bank accounts also increased. The accounts remained active as long as I worked in the respective institutions and received salary there, but once I left the institutions, the accounts also turned inactive.”

He is not even sure how much money is in which bank account. “There must be two or three hundred rupees in each account. For such a small amount, it doesn’t make sense to go and reactivate those inactive accounts,” said Basnet.

The number of people who open bank accounts and then leave them inactive after going abroad is also significant. Whether for foreign employment or studies, people tend to leave some money in the accounts they had opened before leaving.

Salina Basnet from Sindhupalchok is currently in Australia. While in Nepal, she had opened accounts in seven banks to trade in the stock market. She says there could be around 10,000 rupees in all those accounts combined. “I had accounts in seven banks. There is some money in each of them. Altogether, it must reach around 10,000 rupees,” she said.

Similarly, there are plenty of people who open accounts in various banks and financial institutions, transact for a while, and then leave them inactive. Most people open accounts for some specific purpose, and after leaving the minimum balance, abandon them inactive.

According to data obtained by Nepal News from Nepal Rastra Bank through the Right to Information Act, as of the end of last fiscal year, the number of inactive accounts of ordinary citizens and organizations opened in banks and financial institutions across the country stands at 19,013,413. By the end of last fiscal year, these accounts held an unclaimed balance of Rs 188,350,592,198.

In 2016, the government had announced the ‘one person, one account’ policy to expand access to banking services for all citizens and strictly implemented it through Nepal Rastra Bank. After that, the number of deposit accounts increased. As of the end of last fiscal year, the total number of accounts opened in banks and financial institutions had reached 59,881,353. Meanwhile, according to the 2021 census, Nepal’s total population is only 29,164,578. https://english.nepalnews.com/s/business/rs-188-billion-of-the-general-public-piled-up-in-inactive-accounts/

According to Nepal Rastra Bank’s Executive Director and Spokesperson Kiran Pandit, the large number of accounts in banks and financial institutions may also be due to the tendency of people to open accounts for different purposes and not close them once the purpose is over.

The unified directive issued by Nepal Rastra Bank in 2024 states that if no transactions are made from a current account in a bank or financial institution for one year, such an account must be classified as inactive. The directive says: “If no transactions are made in savings accounts for three years, and in call accounts and current accounts for more than one year, such accounts must be made inactive.”

When updating such accounts, the respective institutions are required to do so according to the customer identification policy. For this, the concerned individual must be physically present at the bank to update their details. In recent times, however, Nepal Rastra Bank has made provisions that accounts can also be updated by identifying customers through electronic means.

How much money is in the inactive accounts of each bank?

A total of 54 banks and financial institutions are operating in Nepal, including 20 commercial banks, 17 development banks, and 17 finance companies. Among them, the highest number of inactive accounts are in commercial banks.

According to the central bank’s data, the five banks with the highest number of inactive accounts are Rastriya Banijya Bank, Global IME, Prabhu, NIC Asia, and Nepal Investment Mega Bank (NIMB). As per the data up to the end of last fiscal year, Rastriya Banijya Bank alone has 1,857,243 inactive accounts. Similarly, Global IME Bank has 1,808,543, Prabhu Bank has 1,386,072, NIC Asia has 1,296,011, and NIMB has 1,111,283 inactive accounts.

Among the inactive accounts, the highest amount of money is held at Nepal Bank. In the country’s oldest bank, the inactive accounts contain Rs 23,475,591,664.

In Nabil Bank, which has foreign investment, the inactive accounts hold Rs 14,151,686,000. Agricultural Development Bank also falls among the banks with a large amount of money in inactive accounts. In that bank, the inactive accounts show Rs 10,070,220,000.

Among development banks, Muktinath Development Bank has the highest amount in inactive accounts. The inactive accounts of that bank contain Rs 7,423,220,000. Similarly, the inactive accounts of Jyoti Development Bank hold Rs 5,901,200,000. https://english.nepalnews.com/s/business/rs-188-billion-of-the-general-public-piled-up-in-inactive-accounts/